Synthetic loans are traded on stocks exchanges. SyntheticFi makes it easier for you to access them on your existing investment platforms.

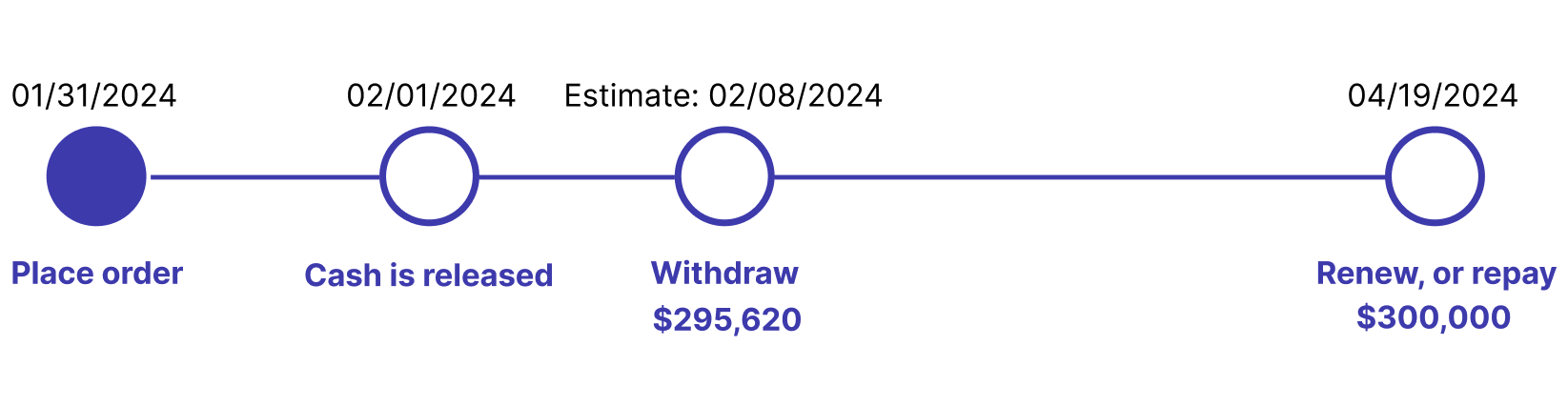

Synthetic loans are standardized contracts traded on stock exchanges. They allow you to receive cash front, and require repayment with interest later. The interest rate and due date are set ahead of time.

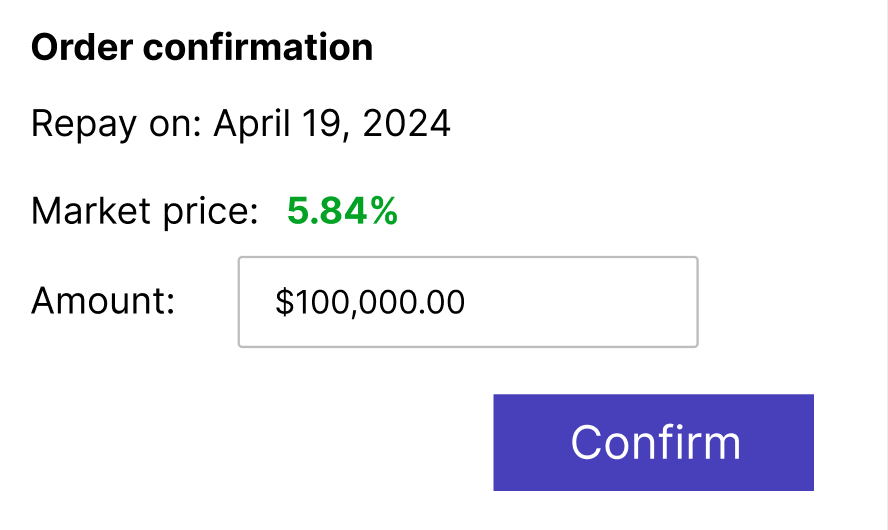

Their pricing is set through an open bid-ask process on stock exchange. That's why they are very competitive in pricing and usually much cheaper than margin loans offered by brokerage platforms.

Get the best price based on bids and asks on exchange.

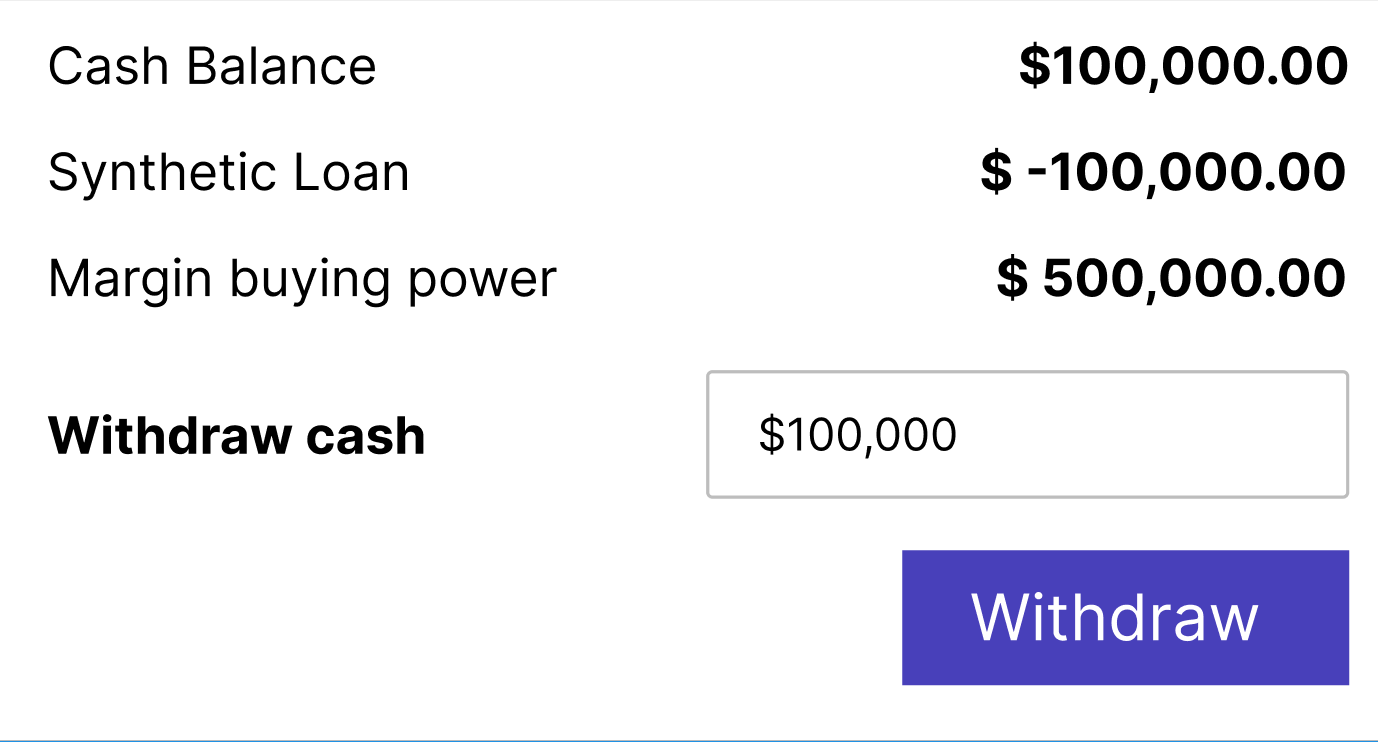

Margin maintenance requirement from the custodian applies to make sure you can repay the loan.

At SyntheticFi, a synthetic loan is constructed with a short box spread on S&P 500 Index options traded on CBOE.

Not exposed to stock market fluctuations: it always settles with a fixed amount at expiration.

No early exercise risk: Options used are European-style with a pre-defined expiration date to repay.

Get the best rate: Interest rate is transparently set through competitive bidding on the exchange.

Schedule a video call with one of our licensed professionals.